Snap published its second quarterly earnings report as a public company on Thursday, missing Wall Street estimates. But amid concerns about its growth prospects, the platform has one big advantage over its competitors say marketers – at least as far as attracting ad dollars is concerned – and that is its Discover section.

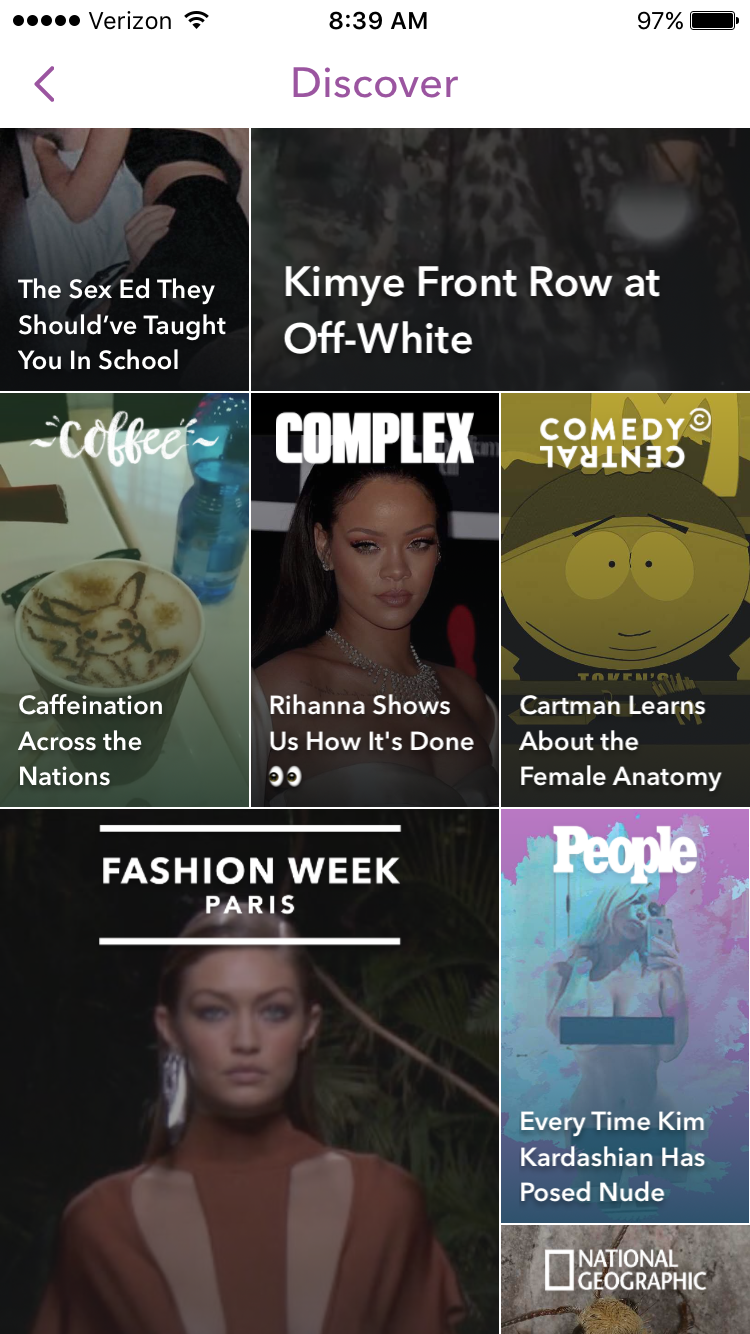

Discover is Snapchat’s content and entertainment hub, a dedicated section where its media partners post slideshows, articles, videos and original shows in its signature vertical format. The section not only offers advertisers an environment filled with better-quality content than Snapchat’s user-generated Stories, but it is often content that they can more closely align with.

“Discover is very attractive for advertisers as it adds another layer of targeting as far as users are concerned,” said Sherwin Su, associate social director at digital agency Essence. “It’s like traditional print advertising and running an ad in a magazine that you know will certainly reach a certain type of audience, but in a digital set-up.”

Original programming and content from trusted, and well-established publishers and partners that makes up Discover is a huge asset for Snapchat, echoed Mike Dossett, associate director of digital strategy at digital agency RPA.

"Context matters for advertisers and Discover offers a dedicated environment that you can buy exclusively against," he said. "You can not only be sure what type of content your ads will appear against, but there is also benefit with being associated with highly credible publishers that already have brand equity with the audiences."

Advertisers can buy multiple types of ads on Snapchat, including sponsored geofilters, sponsored lenses and Snap ads that run between users' stories - which can be easily bought using its self-serve platform. But Discover is considered "premium" or the most ad-friendly, and most ads are bought from a "direct sold inventory," directly from Snapchat.

This is a because Discover allows ads to appear in very specific contexts, which is a huge draw for brands, especially at a time when brand safety (and where and against what type of content ads appear against) has emerged as a big concern.

Brands can choose among Snap ads in between articles and videos, channel takeovers, custom ads running against shows, sponsorships for shows and even product integrations. Ads on Discover also tend to be "three to five times more expensive," according to a buyer. It is working well for Snapchat so far, with almost half of Snapchat's revenue last year being generated by ads within the Discover section, according to eMarketer.

"Advertisers are getting to a place where they're starting to understand that an ad on social is not just an ad on social - that certain places are meant for optimizing reach and scale and others for engagement or changing perception," said Doug Rozen, chief digital and innovation officer at OMD Worldwide. "They have realized that they can often do more with Snapchat in a limited time in terms of premium content versus being in-feed on Instagram."

Discover, particularly shows, remain a priority for Snap, which plans to have as many as three shows airing per day on Snapchat Discover by year-end, according to Digiday. But while Discover has been an important differentiator for Snapchat thus far, competition is only heating up.

Both Google and Facebook are now hoping to get in on the action, with Stamp and Watch respectively. While Stamp will let publishers create visual-oriented media content along the lines of Discover on Google, Watch is Facebook's redesigned video tab which will showcase a slew of shows from the likes of BuzzFeed, Tastemade, Condé Nast Entertainment, and ATTN. While Watch is initially intended just for Facebook, it's highly likely that it will eventually translate over to Instagram, as Facebook products often do, said RPA's Dossett.

"Snapchat has a head start, commitment from established content partners and consumption and audience data from over a year in market with Discover," he said. "But as we've seen, when Facebook 'flips the switch,' scale can follow extremely quickly for quality products."